Tax Administration

Event Espresso 4 gives you several ways to administer taxes for your event and report those fees to registrants who purchase tickets. Event managers can administer taxes globally and on a per-ticket basis.

acf domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121blackhole-bad-bots domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121debug-bar domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121easy-pricing-tables domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121geoip-detect domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121members domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121affiliate-wp domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121pue-sales domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121better-click-to-tweet domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121pue-amazon domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121pue-bbpress domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121pue-stats domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121wordpress-seo domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/staging-poc/public_html/wp-includes/functions.php on line 6121Event Espresso 4 gives you several ways to administer taxes for your event and report those fees to registrants who purchase tickets. Event managers can administer taxes globally and on a per-ticket basis.

Event administrators can manage taxes globally via the default price types and default prices. Tax fees are also reported to the admin in several ways, and to the attendee during and after checkout.

Basic tax types can be named and configured as flat amounts or percentages of the ticket price. Federal and State sales tax types are made available as default price types which can be modified to be renamed (if necessary) and to set the proper tax rate.

Administrators can enable taxes to be applied to individual taxes that were previously configured as a default price.

Once the Tax Default Price Type has been configured, specific taxes can be made available to be applied on individual tickets (see Per-ticket Tax Administration).

Taxes are reported to event managers in the transaction details and registration report. See https://events.codebasehq.com/projects/event-espresso/tickets/4913

The transaction record details the taxes that were charged for the entire transaction.

The registration report details the taxes that were charged for each registration.

==registrations report image?==

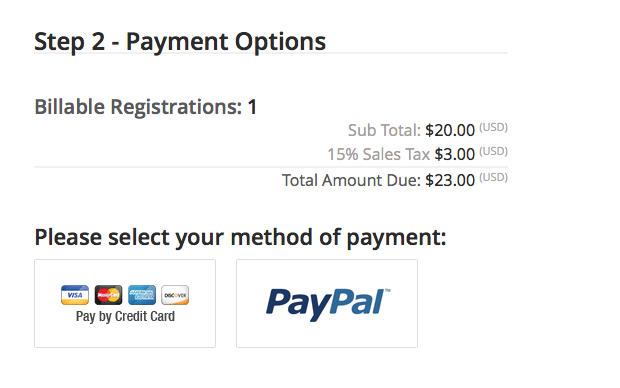

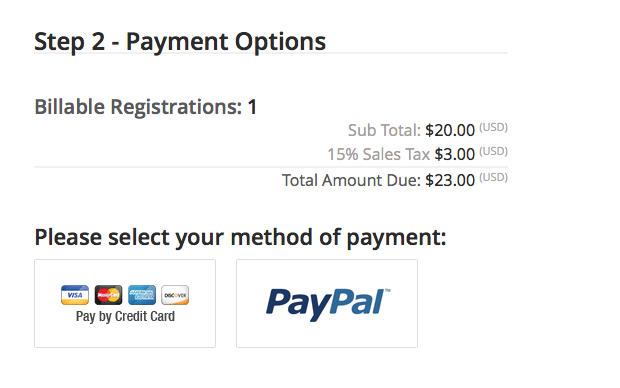

Taxes are reported to registrants in the ticket details ticket selector, during registration checkout, and in their order confirmation (PDF). The PDF order confirmation also reports the VAT/Tax Number configured in Your Organization Settings.

Ticket buyers can read more about a specific ticket which includes the taxes that will be applied to that particular ticket.

===img=== see https://events.codebasehq.com/projects/event-espresso/tickets/4910

The checkout confirmation (before payment) details the amount and type of taxes that will be applied during payment.

The Order Confirmation PDF provides a section that lists the amount of taxes paid for individual types of taxes configured as a default price (above).